Ideal Moving Averages that fit trading

Intraday traders must constantly analyze the current behavior of prices in order as quickly as possible to make a decision to buy or sell. The use of such indicators as moving averages on the intraday charts is excellent for rapid analysis helps to identify current risks, and possible points of entry and exit. Also, moving the macro act as filters, giving information on whether or not to trade, monitor, or wait for more favorable conditions.

Choosing the right moving averages adds reliability to all intraday strategy based on technical tools. In most cases, identical parameters will work in all cases of short-term time frame.

A set of well-chosen moving averages will work in scalping, and during the start of trading, and in the afternoon. In this timeframe, regardless of the effectiveness of moving averages remains high, whether the 1-minute chart, 5-minute or 15-minute chart. Swing traders can also use the MA are 60-minute charts.

Moving Averages with period 05-08-13

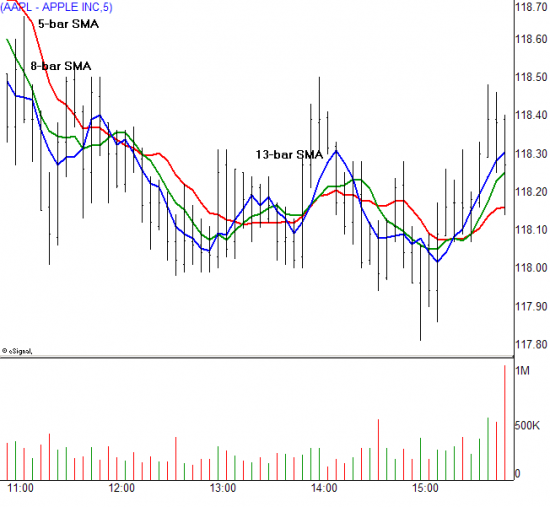

The combination of periods of 5, 8, 13, for simple moving averages (SMA) is ideal for trade within the day.

These parameters are selected based on the Fibonacci numbers, which have passed the test of time. But to use them properly, you must correctly interpret the Moving Averages. It is a visual process that requires a comparison of traffic moving averages of the price.

In general, nothing complicated and new, moving moving up, so it is worth buying down — to sell. Plus there are several formations that give information about current trends and positions, which should take the trader — to wait or act.

Movers in action

Shares of Apple (AAPL) rose above $ 105 (A) on 5-minute chart, thereby breaking the bearish rally (B). Moving average with a period of 5, 8, 13, after the price rise, the distance between the moving expands, signaling strong movement (the rally, if you like) at the moment. The rally fades after 12 hours and lowering the price for moving from a period of 8 ©, when moving from a period of 5 declines, it finds support in the same level (D), followed by the final spurt. Aggressive traders can take profits when the price touches the 5-period moving average, or wait when MA are cross and the price closes below its (E). Both exit points were sufficiently profitable.

Do not have a position — it is position too

Price and moving averages can also give a signal to the trader — is out of the market. The lack of trend and periods of increased volatility make MA are 5, 8, 13, draw horizontal trend with frequent crossing.

These protective factors should be put in your memory and used as a primary filter for short-term transactions.

How to avoid false alarms?

Stocks AAPL swings in the afternoon, showing choppy and volatile schedule within 1 dollar Rungis. Moving average with a period of 5, 8 and 13 show similar fluctuations with periodic intersection Moving Averages, consistency can not be traced. This kind of noise to indicate the supervisory stockbrokers riskiness of action, it is better to find another stock.

Conclusion

Indicator Simple Moving Average with a period of 5, 8 and 13 indicates excellent entry levels for day-traders looking for a quick deal on the purchase and sale. Removals and also act as a filter, warning about the increased risk of the trader.